By Bapuu Naraaynnkar

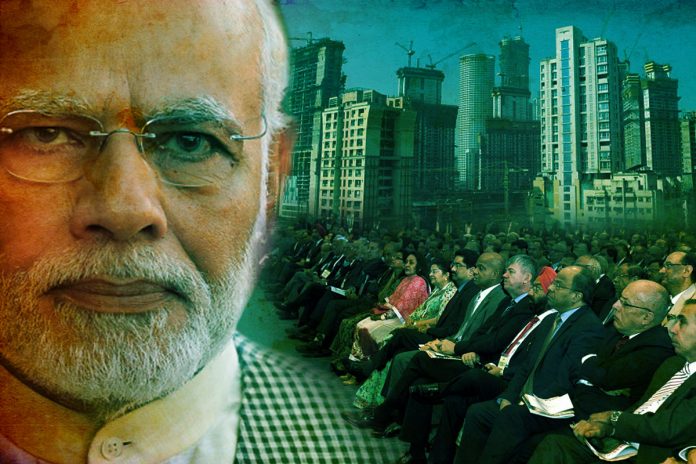

A couple of developments in last few days have taken India’s development story forward and underlined Narendra Modi government’s resolve of ease of doing business.

Many media houses highlighted the dramatic arrests of Sonia Gandhi’s money-bags P Chidambaram and D K Shivakumar on corruption charges, but missed on the benefit it accrues to India’s business prospects.

Former Karnataka Minister and Congress troubleshooter Shivakumar was arrested yesterday by ED in an alleged money laundering case.

The I-T raids on Shivakumar’s properties revealed that the Congress leader’s trans-border hawala transactions was carried out in tandem with Cafe Coffee Day officials.

The sleuths found an unaccounted sum of Rs 1.2 crore at the residence of Singapore citizen Rajnish Gopinath, which he had claimed to have belonged to CCD Founder VG Siddhartha.

They also stumbled upon Shivakumar’s close kin receiving about Rs 20 crore from CCD and M/s Soul Space in a roundabout fashion.

And, Chidambaram was arrested for tweaking norms as finance minister to allow an Indian firm to receive a suspicious foreign investment, for doing so, his son Karti Chidambaram received kickbacks in crores.

Such high-level political corruption, over the years, has been deterring many foreign investors from investing in India, but Chidambaram’s arrest will certainly give them confidence in looking at India even more.

The foreign investors, in the past, has had a good experience of a clean administration provided by Modi. This is reflected in electronic payment companies experiencing a huge growth since the demonetization. Demonetization is a step to reduce reliance on cash to check corruption, which has left India’s digital economy booming.

Another major development that unfolded was the government’s decision to merge India’s state-run banks, which would boost credit and revive economic growth from a five-year low. The merger would result in higher lending capacity, large cost reduction, cost savings for subsidiaries of each merged entity and tech compatibility. It would also mean better banking to customers, more credit to the industry, agriculture, professional governance structure and a greater autonomy and accountability of bank boards.

Yet another major step taken by the government relates to relaxation of FDI norms in contract manufacturing, coal mining, single-brand retail and insurance intermediaries.

This will not only give a major boost to Make In India programme, but also help companies like Apple-product-maker Foxconn to expand its factories in India, which are mainly assembly plants for China-made components. The easing of FDI rules for coal mining also is a very significant step taken by Modi to revive the energy prowess of the country. India, in fact, is having world’s fifth-largest coal reserves, but is the second-largest importer of coal, thanks to the domestic lobby, which has challenged reforms in energy sector.

By taking this step, Modi has sent a strong message of taking on the domestic lobby to encourage foreign investors to make a foray into coal mining. The foreign investors, with deep pockets and superior technologies, will bid for mining coal in India, which will challenge Coal India’s monopoly, thus opening the doors for private players to compete in the market.

The relaxation of local sourcing norms for single-brand retail will allow companies like Apple and IKEA to ramp up their product lines quickly and start selling their products online in India, before setting up their first brick and mortar units in India. Earlier, the single-brand retailers were allowed to mandatorily source 30 per cent of goods sold in India from the country, but under the new rules, all procurements made in India by them will be considered as local sourcing, regardless of whether the goods are sold in India or exported.

Further, such sourcing is allowed for single-brand retailers or any of its group companies, either directly or through a third party. The five years rule of Modi has seen FDI inflows reaching a record high of $64.4 billion in 2018-19, and the measures listed above, will only take the figures even higher.